Glacier Nonresident Alien Tax Compliance System

Glacier software is used to ensure tax compliance for payments directed to foreign nationals for services performed in the USA. Foreign nationals receiving payment for services will receive an email from support@online-tax.net with a time sensitive login. Foreign nationals that hold Asylee, Refugee, DACA or H2A status do not need to create a Glacier record. Any individuals in these statuses should direct immigration documentation directly to payroll to determine the appropriate tax status and prevent the creation of a Glacier record. The link to the Glacier webpage is https://www.online-tax.net.

Notification

An email from Glacier is directed to the employee’s email address attached to their payroll record ending with @tennessee.edu. For this reason, it is imperative that new employees’ access and review their UT email accounts. If the employee chooses, in Glacier, the information after the @ symbol can be changed but the NET ID or information preceding the @ symbol should not be altered. Glacier and IRIS records are linked by NET ID. To avoid creating two NET IDs for one individual, departments should include an existing NET ID on hire paperwork.

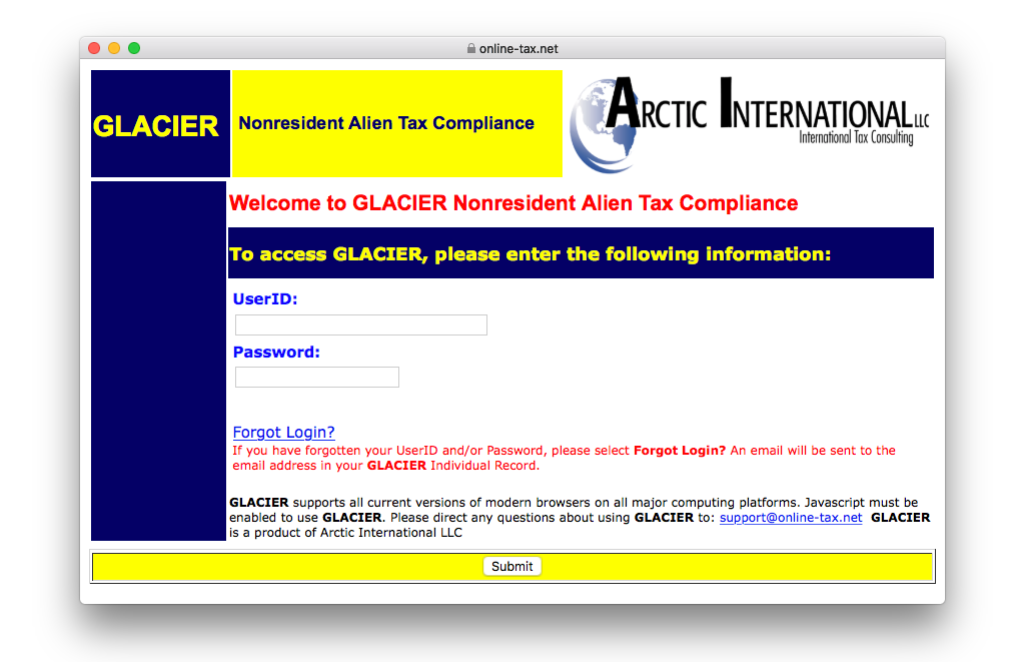

Login

The email will provide temporary login credentials that will need to be changed when logging in the first time. Each individual should keep the new credentials in a safe place for future reference to update glacier as needed. A couple common updates include an extension of stay or a change in immigration status.

Determinations

Glacier determines tax residency, tax treaty eligibility, as well as FICA tax eligibility. Glacier will generate the required tax forms based on elections that are made by each individual. Forms should be printed, signed, and submitted along with copies of required document as direct by the tax summary report instructions.

Tax Reporting

1042-S forms can be accessed via Glacier for tax reporting if indicated when creating the individual record. GTP (Glacier Tax Prep) can also be accessed via Glacier by tax nonresidents to complete their tax returns.